Hello World! Pasmo is one of the smart cards that lets you ride on most trains and buses in Japan. You just tap and go. It can also be used to make purchases at places like convenience stores (7-eleven) and vending machines.

Before I go and write too much about Pasmo, there’s a TON of great information on the official English language Pasmo site. They did a really great job of explaining the ins and outs of Pasmo, but I did want to mention a few things.

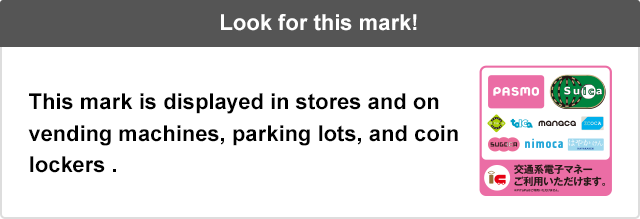

Pasmo is one of several IC (integrated circuit) smart cards available in Japan. You see, Japanese National Railways was privatized in 1987, which created multiple companies (source: Wikipedia). Each company now has their own IC card system. The good news is that the systems have been integrated, so with a few exceptions, you can interchangeably use the cards between systems. When you’re in stores, you’ll see a logo like this:

In Tokyo, Pasmo is one of the major IC cards and Suica is the other. Because of the interoperability, it really shouldn’t make a difference which one you use if you’re a visitor. If you’ll be living in Japan, you may want the Suica as it has capabilities that I haven’t yet seen with Pasmo, such as being able to login online and check your transaction history. Both cards have a credit card auto-charge service that automatically tops up the card for you when needed.

Here’s a bullet of list of facts for you:

- The IC cards are handy because they provide an automated calculation of fares. Japan’s railway network is massive, and it can take a few moments figure out the value of ticket to purchase when your ride includes multiple stops. With the IC card, you never need to calculate the value of ticket to buy; you just tap (or you can even hover the card over the reader) and go.

- As mentioned, IC cards work across Japan (with some exceptions), so you should only need a single card.

- There is a limit of ¥20,000 (about $160USD) that you can load the card up with, so don’t expect to put too much money on the card.

- If you need to get a refund, you’ll get your deposit back (which is ¥500) and your remaining balance (minus a ¥210 fee).

- You have the option to put your name on the card, where you’ll have to provide personal information like your full name, date of birth and phone number. In the event you lose your card, you can get the card cancelled and replaced for a ¥500 fee. Since it costs no extra money to put your name on a card, it’s an easy way to get some extra protection.